artdaily.org has a good summary of the auction

Most important collection of Gursky "Stock Exchanges" to be offered at Sotheby's London

and the official Sotheby's listing is here

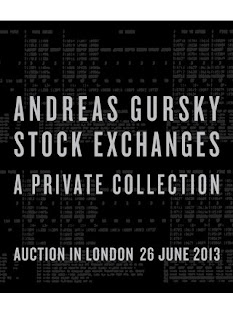

Andreas Gursky Stock Exchanges A Private Collection

It's kinda funny because when I started at the CBOT as a phone clerk, the managing director made comments that I "should be on the other side." Obviously 14 years later it's apparent that he should've meant the other side of the visitor's gallery shooting photos of trading floors rather than the trading side grinding out ticks, assuming risk to the shirt on my back and being a 33 yr/old man w/the insides of a 90 yr/old due to stress. Let me reiterate what this auction is offering, five photos of trading floors for five million dollars!