Vintage 1994 promotional video which was edited to show the floor in pretty hectic action. When I saw the floor in 1999 (I think or 98) it was incredibly quiet so this vid is nice to see what it once was.

Tuesday, August 20, 2013

Sunday, August 18, 2013

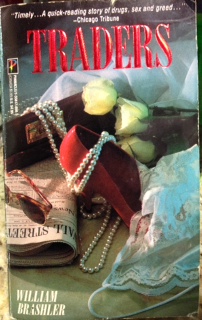

Traders by William Brashler

Moving from highbrow to lowbrow but still set within the long bond pit, my reading stack shrank to finally allow the opportunity to read former WSJ reporter William Brashler's fictional novel Traders. Before my take on it, here is the 1989 review from the Chicago Tribune.

I felt that the book was pretty good, although it was a guilty pleasure reading it because I almost never read fiction. The storyline stretched belief at some points but was generally solid and the various subplots also kept me picking the book up at every opportunity. Since Brashler spent a long time around the trading floor in his role as a journalist, the characters and dialogue were incredibly realistic (too realistic almost) to the point I felt transformed back to the CBOT floor in the 1980s occasionally. My primary critique is that the characters, particularly the protagonist, should've been a bit older in age to be more believable. The book also gets pretty lewd at some points but hey it was the 80s and I figure there's more reality in some of the stories than most would realize (back then "blocker" didn't mean a block trade apparently, LOL).

Traders is a great book to add to your stack and someday it'll make a great read when you're in the mood for a book on trading but one that requires zero thinking.

Wednesday, August 14, 2013

Dao of Capital

photos via: daoofcapital.com

In the soon to be released Dao of Capital, author Mark Spitznagel relates in the first chapter of his great personal story of learning to speculate under the tutelage of an older, folksy pit trader at the CBOT. It's clear how much respect the author has for his mentor, 50+ year CBOT member Everett Klipp, and one great thing about the trading floor was how that sentiment is shared by many others (particularly myself) for their trading mentors.

The first chapter is available via link here and although it takes highbrow diversions into Daoism and Austrian economics (the main subjects of the book), it's worth reading in it's entirety to not miss how he relates what he learned as a trader in the 30yr bond pit during the 1990s. Today I did a skim during the trading day and upon a reread after the mkt close, it was clear how much was missed by simply doing a light reading initially. This is a book which clearly requires no distractions while reading to get the most out of it and is great for summer markets when minds aren't left baked after a volatile trading day.

The strategy which Klipp taught was, as the author wrote, very simplistic and while continually sound in theory, it's difficult to implement in futures anymore without getting deep into the HFT arms race, the extent which is well illustrated in another new book, Architects of Electronic Trading. The reason being that getting trades electronically now is like prison sex, the kind you get you don't want and the kind you want you don't get. However, it was/is an approach and the beautiful thing about the markets is that everyone can define their own way to play the game. I personally disagree w/the strict approach of the "Alpha School" and have always thought a directional bias is important to combine w/market making strategies. As much as I'd like to hammer on this tanget, it's not history related so I'll stop.

The entire book is released in a week and a half so it'll be great to continue reading once the preorder I put in for today ships.

For my own attempt at folksy/Daoist wisdom to share in these slow August markets: it's better to be out of the market wishing you were in than in the market wishing you were out.

Subscribe to:

Posts (Atom)