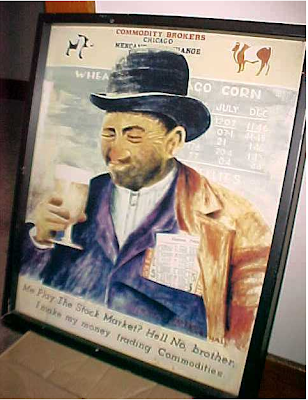

"Me play the stock market? Hell no, brother, I make my money trading commodities."

The art was created by Alfred Marshall and is believed to date from 1969 or the early 1970s.

Electronic Exchanges: The Global Transformation from Pits to Bits is a new book that is certainly the most comprehensive description on how and why trading migrated to electronic markets from the open outcry trading pit. Although it might appear as an academic work, it's very easy to read and a nice historical review of how the exchanges and marketplace has gotten to their current state. The two authors are highly qualified on the topic and the book is an essential addition to anyone who is interested in financial history. The cover photo looks to be of the SIMEX trading pit in Singapore.

Electronic Exchanges: The Global Transformation from Pits to Bits is a new book that is certainly the most comprehensive description on how and why trading migrated to electronic markets from the open outcry trading pit. Although it might appear as an academic work, it's very easy to read and a nice historical review of how the exchanges and marketplace has gotten to their current state. The two authors are highly qualified on the topic and the book is an essential addition to anyone who is interested in financial history. The cover photo looks to be of the SIMEX trading pit in Singapore.

The background of KCBT's twitter page has a good trading pit photo that I thought was worth linking. I'd estimate that 95% of the people in the photo were trading there when I was a clerk back in 1998/99, now of course the only difference is the computers that come into the pit. Click on the photo to enlarge it for more detail.

The background of KCBT's twitter page has a good trading pit photo that I thought was worth linking. I'd estimate that 95% of the people in the photo were trading there when I was a clerk back in 1998/99, now of course the only difference is the computers that come into the pit. Click on the photo to enlarge it for more detail.

1942 was a special year at the CBOT and I'm grateful to add this piece to my collection for the simple reason that memberships were at the lowest price ever. CBOT memberships traded as low as $25 in 1942 as World War 2 resulted in a large amount of trading restrictions and price fixing by the government. It got so bad that I have read reports that some people tried to give memberships away just so they wouldn't have to continue to pay dues but not suprisingly, the potential recipient declined as they didn't want to be on the hook for dues. To give you a perspective on how far the price fell, memberships traded at a low of $800 in 1900 and as high as $62,000 in 1929. All figures are unadjusted for inflation.

1942 was a special year at the CBOT and I'm grateful to add this piece to my collection for the simple reason that memberships were at the lowest price ever. CBOT memberships traded as low as $25 in 1942 as World War 2 resulted in a large amount of trading restrictions and price fixing by the government. It got so bad that I have read reports that some people tried to give memberships away just so they wouldn't have to continue to pay dues but not suprisingly, the potential recipient declined as they didn't want to be on the hook for dues. To give you a perspective on how far the price fell, memberships traded at a low of $800 in 1900 and as high as $62,000 in 1929. All figures are unadjusted for inflation.

One of the finest books ever written on open outcry futures trading is being released in the US as of September 2009 and I highly recommend anyone with an interest in financial history, particularly the evolution of futures trading, to buy a copy of Day One Trader by John Sussex. It is very well written and certainly the finest trading floor book since Charlie D. was published in 1997. The book recounts the experience of one pit trader who was on the LIFFE floor beginning on the first day in 1982 and continues to the present, most interestingly with the indepth story of the transition from the trading pit to electronic trading, which Sussex participated in as a LIFFE director and owner of a dominant floor brokerage.

One of the finest books ever written on open outcry futures trading is being released in the US as of September 2009 and I highly recommend anyone with an interest in financial history, particularly the evolution of futures trading, to buy a copy of Day One Trader by John Sussex. It is very well written and certainly the finest trading floor book since Charlie D. was published in 1997. The book recounts the experience of one pit trader who was on the LIFFE floor beginning on the first day in 1982 and continues to the present, most interestingly with the indepth story of the transition from the trading pit to electronic trading, which Sussex participated in as a LIFFE director and owner of a dominant floor brokerage.